ICO pass: KYC Verification is as Easy as Possible for ICO Organizer

Hallo All, In This New Post I Will Introduce About The ICO PASS Project, And For More Clearly Let's Just Jump The Following Discussion:

KYC inspection is increasingly important, there are many ICO providers who choose the least resistant path (and do not collect any KYC information at all). So one of ICO Pass's ultimate goals is to enable KYC verification as easy as possible for ICO providers.

ICO Pass tries to make KYC verification through a simple and easy task. They develop a set of tools for collecting, verifying, and exchanging information. There is a strong demand increase for this type of service. The main customer of the ICO Pass is someone who will invest in token sales. Person's identity information such as name, phone number, address, photo id, and email were first collected. Then this information is checked with some providers. Once it's signed with a key and encrypted.

The ICO exploded in popularity, passing the classical Venture Capital fund. However, without proper KYC (Know Your Customer) inspection, ICO had difficulty in swapping cryptocurrency for fiat currencies - EUR, USD, and others. Because ICO is getting organized, it makes sense to start thinking about KYC.

The main concern of ICO organizers today is to attract investors and not AML's compliance. This creates a major problem for organizers because about 50% of ICO funds can not be exchanged for fiat currencies - banks reject them.

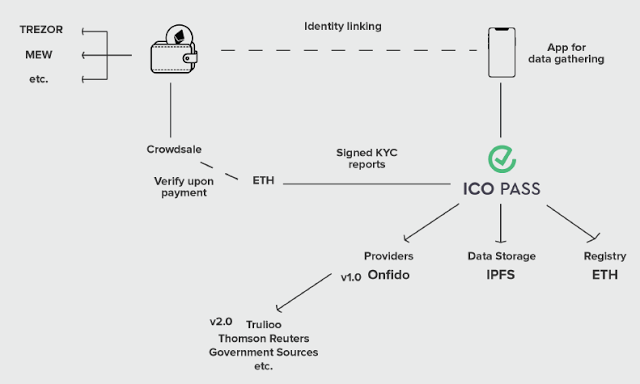

ICO PASS structure

features

Documents are divided into sections. The first section explains how the major ICO Pass components - mobile clients, verification web services, KYC providers and smart contracts used to store and retrieve information about ethereum addresses. The second part describes the mechanics of token sales.

Finally, at the end of the document, there are many attachments. This includes a more thorough explanation, as well as the complete source code of the Ethereum smart contract at the time of publishing this document.

Smart Contract

There are two types of ethereum programs within the ICO Pass scope:

contract infrastructure to verify key holders, issue signed attributes, search attributes, etc.

contract verifier - contract and intelligent library to consume ICO Pass information.

Working from this assumption, we have decided on some design goals:

payments from unqualified addresses must be rejected at the intelligent contract level. This will reduce the amount of work needed afterwards to return an unqualified contributor.

allows verification of contributors to be simple - ideally by not just a Solidity function modifier. This should facilitate the audit constraints.

In addition - a proxy contract can be used to forward only verified funds. However, since the crowd audited should audit the overall setup, the proxy contract does not offer any significant advantages over Solidity function modifiers.

To meet these constraints, KYC data needs to be communicated from Ethereal. Unblocked, ICO Pass consists of a series of contracts, which make it easy to:

prove ownership of ethereum address to verifier.

a registry claim, where the subject address can be matched to the data (signed by a given verifier).

Initially ICO organizers who will adopt ICO Pass, must trust ICO Pass verification key signature - because there will be no other gauges. However, in theory, new gauges can appear and send information about the ethereum address. In addition, ICO Pass also provides some non-blockchain services:

mobile apps to collect information (including photo contributors). Webservice to interact with mobile applications, and sign KYC information collected with the ICO Mobile Pass application.

The mobile application will open-source after the ICO Pass crowd.However, it asks the private key of the end user.Webservice, which verifies KYC and sends signed information to blockchain, will not be made open source at first.

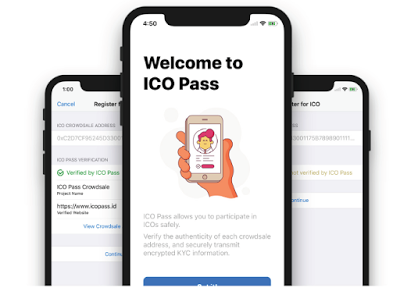

For people interested in contributing to the initial coin offerings, ICO Pass offers mobile apps. It can be used to take photos, verify phone numbers, and load documents. ICO Pass is designed to work with token offerings that use the ethereum blockade. After providing identification information, a series of small ethereil transactions are established to prove ownership of the address. This is very similar to the way traditional banks conduct small transactions to verify accounts to allow ACH transfers. Funds for these small transactions will be refunded including network cost charges.

Mobile Clients

The mobile client acts as a device for collecting information:

This enables the capture of a user's photo or video recording.

This allows taking photos of documents, and instantly gives feedback about their quality.

This allows verification of phone numbers.

It also offers a way to provide easy feedback for contributors:

when KYC inspection is complete.

if more information is needed.

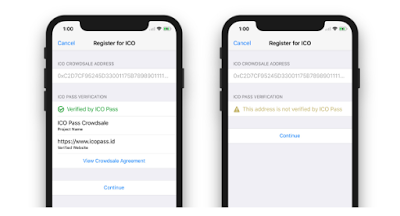

Conduct an ICO address trust evaluation by indicating that the ICO candidate has not been registered.

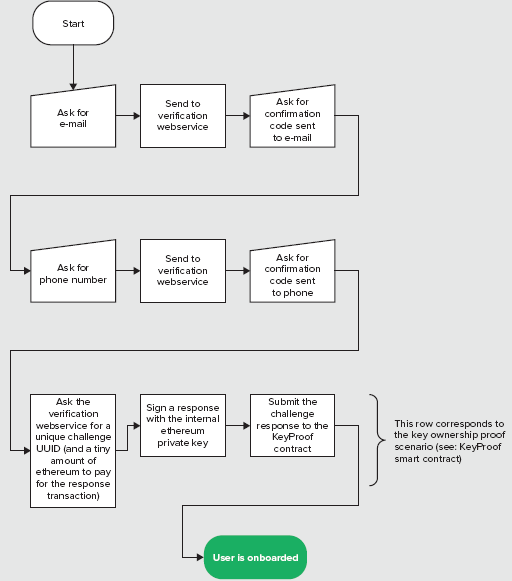

Finally, it can automate tasks for end users, which improves the user experience. It can verify ownership of automatic wallet keys and storage of personal information for reuse in the next ICO. First Run - When ICO Mobile Pass application is launched first, it will generate keypair ethereum, and store it into the keychain of the device. Then do the onboarding with web verification service. Webservice will send the verification e-mail, and the SMS code to the e-mail address and phone number provided by the end user. The webservice will send a small amount of ethereum to the internal address. The application will use it to pay for transactions of proof of ownership key (see: KeyProof contracts in smart infrastructure contract documentation) .After that,

Validation of ICO Organizer

The same mechanisms used to link KYC information with the contributor's address can be used to associate validation information with the organizer's address (crowdsale). Mobile clients recognize the specific claims signed by certain ICO Pass keys, and will show this information to the end user.

Processing Payment Transactions During Crowdsale (aka Address Linking) Because payment transactions to ICO contractor contracts are made from addresses different from the attributes of published ICO contributors, infrastructure contracts and verifiers include a convenience method for creating, maintaining and finding address links. Prior to participating in the crowd, contributors are required to link their payment wallet address to their identity address, issued during the installation process of an ICO passport. The linking is made by making a payment from the purse of the ICO donor candidate payout to the address of the identity subject. The amount transferred is not important because the funds will be returned to the sender, except gas.

After payment has been refunded, the ICO pass application finds incoming transactions and offers contributors to connect the two addresses. Both addresses are stored in blockchain with reference to the appropriate proof of transactions. As long as the contributor crowdsale is referenced with their payment wallet address and ICO crowdingale contract helper function automatically handles subject identification issues, which have the attributes of ICO contributors issued. If the contributor contributor's address is not registered, the transaction will be refunded.

What about non-ethereum funds?

Formally, ICO Pass only supports the Ethereum address. However, crypto that uses the same elliptic curve for its user key must be verifiable as well. ICO Pass does not currently support smart contracts for verifying contributors on non-Ethereal platforms. It has not been tested with Counterparty.

Reasons Why ICO Pass outshines the competition

KYC inspection is a manual process - long and open to human error.

Inaccurate because it only relies on multiple databases for verification.

Such as a black box - not possible in an easy way to determine why the result is as it is.

It is impossible to guarantee that the KYC process information has not been changed, the inability to rely on the process used.

Additional steps are required to comply with the General Data Privacy Policy (GDPR) beginning in May 2018.

Need to put millions of information to stay safe. Also not suitable for use case blockchain, where need to verify address that can access data.

The benefits of ICO PASS

The process is automatic and takes 7 minutes. There is no place for error

Can add and delete multiple databases for identity verification.

Be transparent about what databases are being checked and how accurately - how many populations in certain countries are covered.

Blockchain technology guarantees that once verified, it will remain the same. Others can rely on this and no need to start the process again.

Information is encrypted and only identifiable people can access it.

Blockchain technology provides higher security at lower costs. ICO Pass also verifies the Ethereal address that wants to access KYC data.

What is our ICOP token?

We did not issue tokens as service API keys (utility tokens), nor did we create a new "proof of something" concept to keep our own blockchain. We are building our system on top of Ethereal virtual machine. All transaction fees and payments will be in ETH.

We decided to keep our ICO offerings small and easy, so our ICOP is equivalent to shares for ICO Pass services, or to a total equity token of 60,000,000. Our idea is to distribute the revenue generated by ICO Pass to all ICOP owners via Smart Contract (SC). The ICOP holder will be able to perform intelligent contract queries for ETH per ICOP currently allocated online.

There will be an initial 20,000,000 ICOP sold. We will use the Ethereum smart contract to arrange token sales and the distribution of future funds will be organized through smart contracts as well, as this is the easiest method to do in our brave new digital world. . We are very pleased with the possibility that the Ethereum virtual machine provides and has made the decision to support the community by donating 10% of our net revenue (received through smart contracts) to the ETH Foundation. On average, about 21% of total revenue will be deposited quarterly holders and ICOP will be able to claim their funds accordingly. See an example of the following income distribution from in-app purchases from the Onfido verification service.

Roadmap

February 2017 - Launch of ICO. Product launch.Mar 2018 - New database added for higher accuracy.April 2018 - Video identification with live agent added.May 2018 - ICO organizer communication tool added to contact ICO contributor.June 2018 - Integration with US State Revenue Service or Banks automatically determine whether the first US-based ICO accredited investor.November 2018 - Integration is completed with EU Banks providing their APIs under PSD2 rules. Automatically determines whether the person is accredited by investors.December 2018 - Interest payment function in app.

Use of funds raised

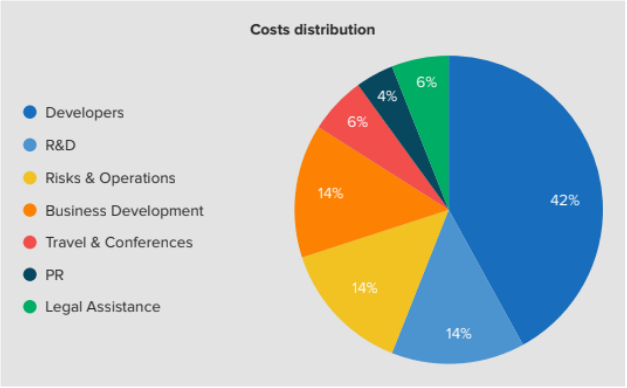

Once the company has completed the roadmap feature and has used the funds from Token Sale, the fund is purely dependent on the funds generated with the ICO Pass open tokens. The ICO Pass receipt will be allocated as follows (see diagram):

50% token will be used to cover the operation, support and further development of the product. This Token will not be sold.10% will be donated to the Ethereum Foundation to support the further development of blockchain technology.20% will be allocated to Marketing. This token will not be sold, but may be given to other parties to promote the service.20% will be allocated to the team. This token will have a period of 1 year where it can not be sold.

Token Sale Information

Sales are auction type sales, whose token prices are time-dependent (token is getting cheaper the longer the sale goes), and the duration of sales depends on the allocation (the more tokens are purchased, the higher the sales deadline). Overall, the ICO Organizer will sell the 20C ERC20 token, called ICOP. Once the organizers issue a new KYC Pass for Bank (KYCP) card, ICOP holders will be able to get 5 KYCP marks for each ICOP sign they hold at no additional cost. The KYCP token holder, on the other hand, will not be able to get tokens for ICOP.

Discount

There will be an initial participation bonus period. Sales will begin with an initial 15% ETH bonus for the first hour. For example, a person spends 100 ETH in the first hour (and this event is included in blockchain), while others spend 115 days later. Both will receive the same ICOP number. For each period in which 2 blocks are confirmed without a new contributor, the initial participation bonus will fall by 1 percentage point. After this 14 events, or after 24 hours (whichever comes first), the initial contribution bonus will be over.

The sales period The crowdsale time should range from a little over a month (without contribution) to 2 weeks (reaching the desired contribution size).

Token allocation tokens will be issued to investors immediately after the end of the sale.

The allocation holder of the Token allocation will be able to claim the quarterly revenue share. Revenue will be available to claim 15 days after the end of the quarter.

Exchange where the token is registered Initially the token exchange will be possible directly between users using Decentralized Exchanges such as Radar Relay.

To Get More Information And Join The Current PASS ICO Project Please Visit Some of The Next Links / Sites:

WEBSITE: http://bit.ly/2rOFrhj

WHITEPAPER: http://bit.ly/2nkGfoE

TWITTER: http://bit.ly/2DHowys

FACEBOOK: http://bit.ly/2DWfAJe

ANN THREAD: http://bit.ly/2Fy3djF

Author by: Naomikatarina

https://bitcointalk.org/index.php?action=profile;u=1263324

Komentar

Posting Komentar