Equitybase - Offers Property Investment

I will explain again about Equitybase,

Equitybase is through a commercial real estate ecosystem to evaluate projects, credit risk, liquidity, entirely on blockchain.

Hybrid Market Platform

In the Equitybase hybrid market platform, users will be able to invest for the economic rights of the property, shown by each Real Estate Offer (REO) within the Investigation Equity platform. Equity to be backed by physical real estate assets. Investors can also trade, liquidate Real Estate holdings on the Equity Exchange platform.

Equitybase's Hybrid Market platform will offer a simple, transparent and direct property investment. Project sponsors and developers around the world can also use it platforms with identical functions. Therefore, we will offer various products in platform such as:

- Debt.

- Preferred equity.

- Equity joint.

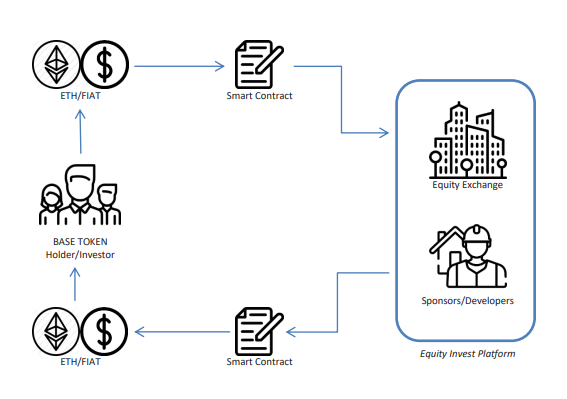

Equity Invest

Equity Invest will be based on a smart Etherum contract that represents the acquisition of property (We call this Real Estate Offer). Once a new property asset goes into the equity investment platform, there will be a list of tasks needed to be performed. This information will be audited and shared with the platform investors. Information will be entered as:

- Price.

- Recommended hold period.

- Annual cash rate target.

- IRR target.

- Target multiple equity.

All returns are calculated based on the recommended hold period on each specific

dealing.

dealing.

- REO ID and type of offer

- amount of funds

- Suggest Durable Period

A Real Estate Offer or REO will represent shares on each property. Each investor will be able to exchange or liquidate their ownership of the property participation through our equity exchange platform. REO can also be traded on the equity exchange platform.

Equity Exchange

Equity Exchange offers investors a standard way to buy and sell investment assets carried out on Equity Invest. Equity Exchange allows trading of real estate or real estate funds to be similar to the stock market without a lock-in period. This will increase the intrinsic value of the performance and demand of each ownership separately.

Equity Reserve

Equity Reserve will enforce as a secondary reserve operator that provides additional

liquidity layers to the Equity Exchange platform, will be used as a reserve pool to enable

platform users continuously to liquidate their holdings with buyback assurances on the exchange.

liquidity layers to the Equity Exchange platform, will be used as a reserve pool to enable

platform users continuously to liquidate their holdings with buyback assurances on the exchange.

Investors and sponsors can manage their accounts, liquidate and invest through mobile Equitybase applications.

Equitybase applications connect users to blockchain by utilizing smart contracts, users will be able to access assets and investment information whose value is recorded in a blockchain ledger.

Equitybase applications connect users to blockchain by utilizing smart contracts, users will be able to access assets and investment information whose value is recorded in a blockchain ledger.

Pile of investment

This type of investment describes the relationship between equity and debt. The bottom of the bottom in the pile the lower the risks to the capital, and vice versa as you move higher. As you climb the

pile, risks and potential rises increase.

pile, risks and potential rises increase.

Often when you hear someone describe the financial structure of a real estate deal they will refer to the "pile of capital".

For more info visit the link below:

- WEBSITE: https://equitybase.co/

- WHITEPAPER: https://equitybase.co/equitybasewhitepaper1.pdf

Komentar

Posting Komentar